Table of Content

For years, traditional credit scoring models have been the cornerstone of lending decisions. They evaluate creditworthiness and determine the likelihood of default on credit obligations.

But now, these models are showing their age.

That’s because they lack the adaptability to process real-time information, such as social signals, transaction behavior, and digital footprints. Instead, they rely heavily on historical data, missing emerging fraud patterns.

This means two things:

- High-risk customers slip through the cracks.

- Creditworthy individuals are denied access to financial services.

And it’s the first point that demands your attention.

If you’re familiar with recent AI trends, you’ll likely agree that financial fraud is a looming threat that has the power to cripple your fintech company.

From account takeovers to synthetic identities, you can’t afford to depend on outdated fraud detection methods to protect your business and customers—not to mention dealing with severe reputational damage that can take years to recover from, if ever.

Thankfully, Artificial Intelligence (AI) changes it all.

Because it can analyze vast amounts of data in real-time and spot patterns invisible to human analysts or traditional regulatory reports, it has the potential to account for the nuances of a modern, digital-first economy.

This blog post explores AI-powered fraud detection and credit scoring in detail—we’ll study their importance, key technologies, and workings.

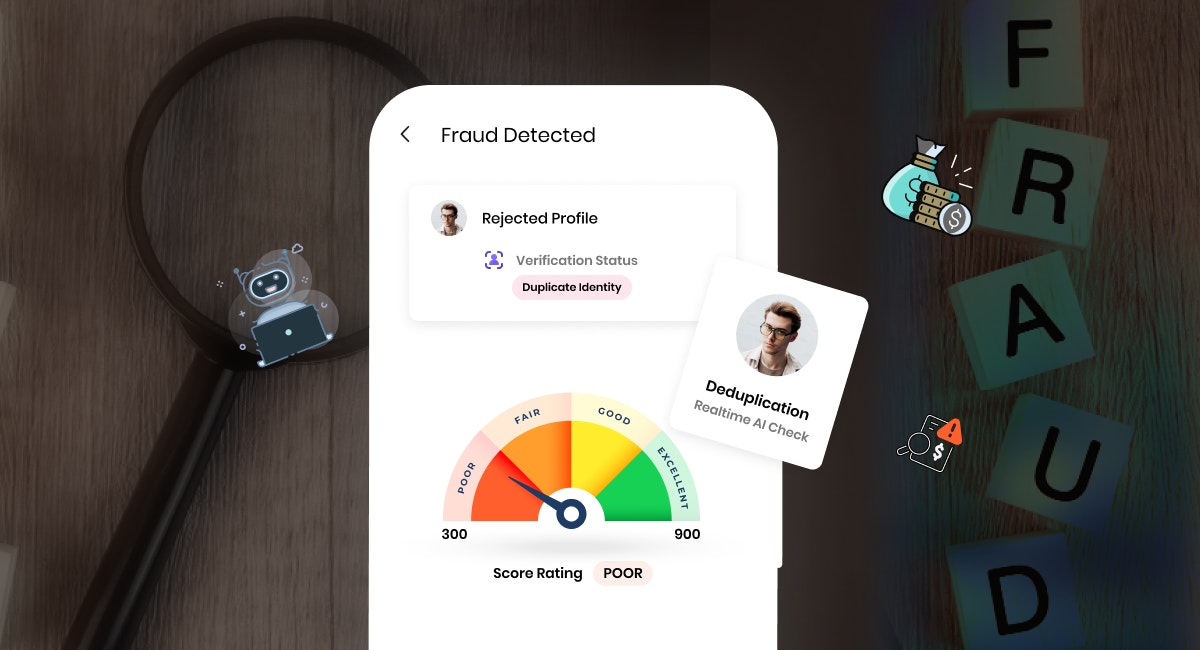

What Is AI-powered Fraud Detection?

It refers to using AI and Machine Learning (ML) technologies to analyze transactions in real-time, identify and prevent fraudulent activities by detecting anomalies, and adapt to new types of fraud as they emerge.

Rule-based fraud detection vs. AI-powered fraud detection

Traditional rule-based fraud detection systems operate on predefined criteria set by human experts.

They’re often rigid and unable to adapt quickly to new threats, requiring constant updates to remain effective. Moreover, they tend to generate a high number of false positives, increasing unnecessary manual reviews.

On the other hand, AI-powered systems learn from new data, refining their models without the need for constant human intervention. The rate of false positives automatically decreases, and fraud detection becomes more efficient.

Types of fraud AI can detect

If, for instance, AI recognizes a credit card being used in multiple locations within a short timeframe with unusual spending patterns, it can freeze the account and notify the cardholder.

Or, if a customer’s login behavior suddenly changes, such as accessing accounts from a new device or location or making large withdrawals quickly, AI can flag this as suspicious and trigger additional authentication steps.

AI can also analyze transactions across multiple accounts and institutions that suggest layering, structuring, or other money laundering tactics—for example, detecting new accounts making high-risk transactions shortly after creation.

What Is AI Credit Scoring?

It’s the process of using AI and ML algorithms to assess the creditworthiness of an individual or business.

While traditional credit scoring systems typically depend on credit history, debt levels, and repayment behavior, AI credit scoring goes a step further and incorporates an array of data sources, including:

- Overall transactions

- Utility and rent payments

- Social media and digital footprints

- Employment and educational background

The technology accurately pinpoints the early indicators of credit risk, whether high or low. It adapts to new information and reduces biases based on age, location, or race, leading to fairer lending decisions.

This allows for a more comprehensive assessment, particularly benefiting those who might be underserved by traditional credit models, such as young adults, recent immigrants, or those in emerging markets.

Secure Your Financial Lending with AI-powered Fraud Detection & Credit Scoring!

Let's Get StartedAI Technologies Used for Fraud Detection and Credit Scoring

In addition to ML, the following technologies are uniquely applied to fraud detection and credit scoring.

- Deep Learning uncovers minute irregularities in transaction data, while in credit scoring, it processes structured and unstructured data to improve decision accuracy.

- Computer Vision assesses visual data, such as property images, in loan applications or performs identity verification via facial recognition to authenticate documents like passports, driver’s licenses, or checks.

- Big Data Analytics processes transaction logs, customer interactions, and external data sources to recognize trends that suggest fraudulent schemes, such as coordinated attacks across multiple accounts.

- Natural Language Processing (NLP) analyzes unstructured data sources, such as emails, social media posts, or customer service interactions, to flag messages that resemble phishing attempts or social engineering tactics.

How Does AI Fraud Detection and Credit Scoring Work?

It follows a five-step process as follows:

1. Data collection and preprocessing

AI algorithms first collect the data from various sources. This raw data is often messy, containing missing values, noise, or irrelevant information. With preprocessing, the datasets are cleaned, normalized, and transformed into a format suitable for analysis.

2. Feature engineering

This involves creating new features like “transaction velocity” or “debt-to-income ratio” or modifying existing ones to make them more informative for the model.

In fraud detection, the goal is to identify patterns and indicators that suggest fraudulent activity.

For instance, transaction velocity, which refers to the frequency of transactions within a specific timeframe, can be an important feature.

A sudden spike in transaction velocity may indicate fraud. Similarly, behavioral biometrics such as typing speed or mouse movements help verify user identity.

In credit scoring, feature engineering is focused on reflecting an individual’s creditworthiness. Payment history is critical, showing whether a person consistently meets financial obligations.

The debt-to-income ratio offers insight into financial health by comparing an individual's debt to their income. Spending patterns, including how individuals manage savings, expenditures, and investments, also play a role in assessing creditworthiness.

3. AI model training and validation

Once the features are developed, the next step is training the AI model using historical data—for example, fraudulent vs. legitimate transactions, high-risk vs. low-risk borrowers, and so on. The model’s objective is to minimize errors in its predictions.

After training, the model is validated using a separate dataset that it has never seen before. This step ensures that the model generalizes well to new data and does not overfit the training data.

Validation metrics, such as accuracy, precision, recall, and F1 score, are used to evaluate the model’s performance.

4. Real-time scoring process and fraud detection

In real-time operation, the trained AI model evaluates transactions as they occur, using the engineered features to determine whether each transaction is likely fraudulent.

For example, if the model notices a pattern where a user suddenly starts making transactions in multiple foreign currencies within a short time frame, it could flag the activity for further review or proactively block suspicious actions.

The AI model also assesses new credit applications by analyzing the applicant’s features, such as payment history and debt-to-income ratio.

Based on this analysis, it assigns a credit score, which helps determine whether to approve the application, adjust the interest rate, or suggest alternative credit products.

5. Continuous learning and model updating

Fraudsters are constantly developing new tactics, so the model needs to learn from recent fraud cases to stay ahead.

This might involve periodically retraining the model or implementing online learning techniques in which the model updates itself in real time as new data arrives.

Importance of AI Fraud Detection and Credit Scoring

- AI speeds up transaction approvals and credit decisions, reducing waiting times and improving customer experiences by minimizing false fraud alerts.

- AI processes transactions and credit decisions almost instantly, improving efficiency, customer satisfaction, and operational throughput.

- AI detects and prevents fraudulent activities in real-time, reducing financial losses from chargebacks, legal fees, and fund recovery.

- AI adapts to new risks in real-time, providing more accurate risk assessments by analyzing diverse data sources.

Enhance Financial Fraud Prevention & Credit Accuracy with AI!

Contact UsHow Intuz Helps You Implement AI for Fraud Detection and Credit Scoring

Are you ready to harness the power of AI to protect your business and better serve your customers? You can count on us to revolutionize your fraud detection and credit scoring processes.

We start by assessing your current systems, working with your team to highlight challenges, and setting clear, actionable goals for AI implementation. This ensures the solution fits your business needs and delivers tangible results.

A robust data strategy is key.

We, therefore, help you identify the most relevant data sources and ensure your data is clean and high-quality for effective AI training. If needed, we assist in improving data collection and filling any gaps.

We then guide you through the critical "build vs. buy" decision. Intuz evaluates your specific requirements and resources to determine the most cost-effective and scalable solution—whether it’s custom development or integrating third-party AI platforms.

Once the technology is in place, we train AI models specifically tailored to your data.

Our experts fine-tune ML algorithms to ensure your AI solutions fit seamlessly with your existing systems. This allows for real-time transaction processing and credit applications without disrupting your operations.

Before going live, we rigorously test the AI models, simulating various scenarios to ensure accuracy and reliability.

Even after deployment, Intuz provides ongoing monitoring and updates. We track performance, make adjustments as needed, and ensure your AI system remains effective and continuously delivers value.

Partnering with Intuz means gaining a competitive edge with AI solutions designed specifically for you.

Book a free consultation today with our AI experts to discuss a personalized AI integration strategy for your business.